The Rise of Bitcoin NFTs and Ordinals: Unlocking New Frontiers

This groundbreaking technology has the potential to revolutionize various industries and sectors, ushering in a new era of innovation and disruption.

The cryptocurrency world has witnessed a remarkable shift in recent months, as the introduction of Bitcoin NFTs and the Ordinals protocol has ignited a new era of innovation and excitement on the Bitcoin network. Once considered a purely transactional blockchain, Bitcoin is now embracing the concept of digital scarcity and ownership, opening up a realm of possibilities that could redefine the way we perceive and interact with this pioneering cryptocurrency.

As the world eagerly anticipates the next phase of Web3 evolution, the emergence of Bitcoin NFTs and Ordinals has sparked a renewed interest in the Bitcoin network, captivating both enthusiasts and newcomers alike. In this comprehensive article, we will delve into the intricacies of this groundbreaking development, exploring its mechanics, implications, and the potential it holds for shaping the future of blockchain technology.

Understanding Bitcoin NFTs and Ordinals

Bitcoin Non-Fungible Tokens (NFTs) are unique digital assets minted on the Bitcoin blockchain, leveraging the Ordinals protocol. Ordinals, developed by engineer Casey Rodarmor, introduces a novel way to inscribe and store data on the Bitcoin network, enabling the creation of provably scarce and immutable digital artifacts.

These Bitcoin NFTs, often referred to as "ordinals," are similar in concept to their Ethereum counterparts, but with a crucial difference – they are native to the Bitcoin blockchain. This means that Bitcoin NFTs benefit from the robust security, decentralization, and immutability that have made Bitcoin a leading force in the cryptocurrency landscape.

Unlike traditional Bitcoin transactions, which are primarily designed for transferring value, Ordinals facilitate the inscription of arbitrary data onto individual satoshis (the smallest unit of Bitcoin). This data can range from images and videos to text and code, effectively transforming these satoshis into unique and verifiable digital assets.

The Allure of Digital Scarcity on Bitcoin

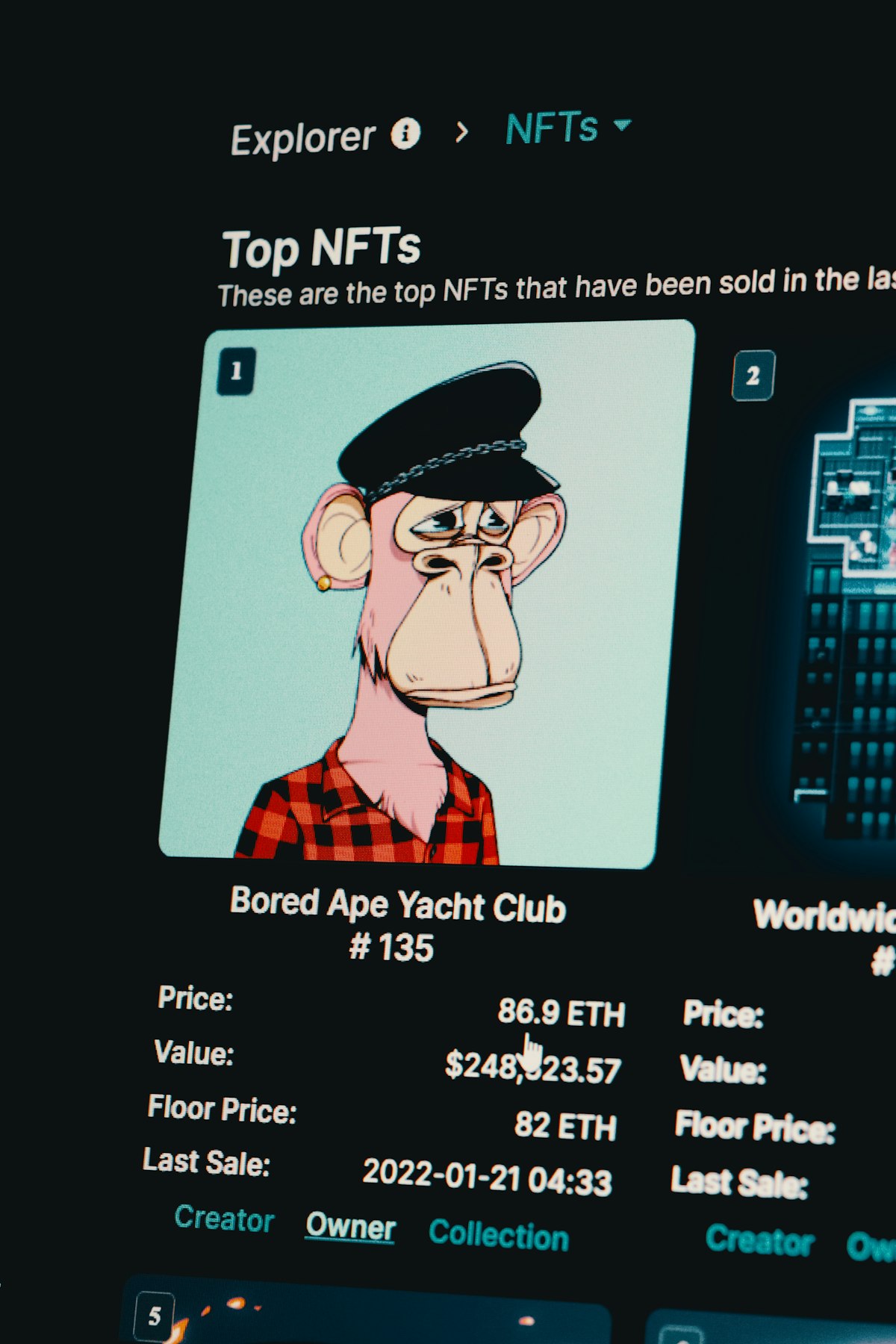

One of the key driving forces behind the success of NFTs on other blockchains has been the concept of digital scarcity. By minting unique and non-replicable assets, NFTs have revolutionized the ownership and value proposition of digital items, opening up new avenues for artists, collectors, and enthusiasts alike.

The introduction of Bitcoin NFTs and Ordinals brings this same allure of digital scarcity to the world's leading cryptocurrency network. Suddenly, Bitcoin, once perceived as a purely transactional medium, can now serve as a canvas for creativity, art, and digital collectibles.

As the demand for Bitcoin NFTs continues to grow, the potential for new use cases and applications becomes increasingly apparent. Imagine a world where rare digital artworks, limited-edition collectibles, and even in-game assets can be minted and traded on the Bitcoin blockchain, opening up new revenue streams and opportunities for creators and entrepreneurs.

According to a blog post by Transak, the Ordinals protocol introduces a new type of transaction called an "inscription transaction," which allows users to inscribe data onto individual satoshis. This data can then be transferred, traded, or collected like traditional NFTs, but with the added security and decentralization of the Bitcoin network.

Driving Innovation and Adoption

The rise of Bitcoin NFTs and Ordinals is not only captivating existing Bitcoin enthusiasts but also drawing in a new wave of users and developers who are eager to explore the possibilities of this innovative technology. This influx of talent and creativity promises to fuel further innovation within the Bitcoin ecosystem, potentially leading to the development of new platforms, marketplaces, and tools specifically tailored for Bitcoin NFT creation and trading.

As highlighted in a video by Andreas Antonopoulos, the introduction of Bitcoin NFTs could potentially serve as a catalyst for broader cryptocurrency adoption. As more people become familiar with the concept of digital scarcity and ownership on the Bitcoin blockchain, it may pave the way for a deeper understanding and appreciation of the underlying technology, ultimately driving further adoption and mainstream acceptance.

Moreover, the emergence of Bitcoin NFTs could also open up new avenues for collaboration and cross-chain interoperability. As explained in OKX, developers are exploring ways to bridge Bitcoin NFTs with other blockchain ecosystems, enabling seamless transfer and integration of digital assets across different networks.

Potential Use Cases and Applications

The possibilities of Bitcoin NFTs and Ordinals extend far beyond the realm of digital art and collectibles. This groundbreaking technology has the potential to revolutionize various industries and sectors, ushering in a new era of innovation and disruption.

One exciting potential application lies in the world of gaming and virtual economies. Game developers could leverage Bitcoin NFTs to create unique in-game assets, such as rare weapons, skins, or virtual real estate. These digital items could then be traded, sold, or collected by players, adding a new layer of value and ownership to the gaming experience.

In the sports industry, Bitcoin NFTs could be utilized to create unique digital memorabilia, such as limited-edition trading cards or highlight reels. Sports franchises and athletes could mint these NFTs, offering fans a new way to connect with their favorite teams and players while also generating additional revenue streams.

The music industry could also benefit from the rise of Bitcoin NFTs. Artists could mint unique digital albums, artwork, or even backstage passes as NFTs, providing fans with a new way to support their favorite musicians while also obtaining rare and valuable digital assets.

Beyond these examples, the applications of Bitcoin NFTs and Ordinals are limited only by the imagination of developers and creators. From supply chain management and provenance tracking to digital identity and certification systems, the potential use cases are vast and far-reaching.

The Role of Decentralized Marketplaces

As the ecosystem around Bitcoin NFTs and Ordinals continues to grow, the importance of decentralized marketplaces cannot be overstated. These platforms, built on the principles of decentralization and peer-to-peer transactions, will play a crucial role in facilitating the buying, selling, and trading of Bitcoin NFTs.

One such decentralized marketplace is Ordinals Wallet, which aims to provide a user-friendly interface for managing and trading Bitcoin NFTs. By leveraging the power of the Bitcoin network, these marketplaces eliminate the need for intermediaries and centralized authorities, empowering users to take full control over their digital assets.

Additionally, decentralized marketplaces offer enhanced security and transparency, as all transactions are recorded on the immutable Bitcoin blockchain, reducing the risk of fraud or manipulation.

Challenges and Considerations

While the emergence of Bitcoin NFTs and Ordinals presents an exciting new frontier, it is not without its challenges and considerations. One of the primary concerns revolves around the potential strain on the Bitcoin network's resources, as the inscription of data and the creation of NFTs could lead to increased transaction fees and network congestion.

Additionally, the debate surrounding the environmental impact of Bitcoin mining and energy consumption may be reignited, as the increased demand for Bitcoin NFTs could potentially drive up the network's overall energy usage. However, it's important to note that ongoing efforts to transition to more sustainable and renewable energy sources for mining operations could help mitigate this concern.

Furthermore, the regulatory landscape surrounding Bitcoin NFTs remains largely uncharted territory. As with any new and innovative technology, there may be legal and regulatory hurdles to overcome, particularly in areas such as intellectual property rights, taxation, and compliance.

As highlighted in a Focal article, there are also concerns regarding the potential for Bitcoin NFTs to be used for nefarious purposes, such as money laundering or the distribution of illegal content. Addressing these concerns will be crucial for the long-term success and adoption of Bitcoin NFTs.

Scalability and Performance Considerations

Another important consideration is the scalability and performance of the Bitcoin network in the face of increased demand for Bitcoin NFTs. While the Bitcoin blockchain is known for its robustness and security, it has historically faced scalability challenges, particularly when it comes to handling a large volume of transactions.

As more users and applications embrace Bitcoin NFTs, the network may experience increased strain, leading to higher transaction fees and longer confirmation times. This could potentially hinder the widespread adoption of Bitcoin NFTs, especially for time-sensitive or high-volume applications.

To address these scalability concerns, various solutions have been proposed, including the implementation of second-layer scaling solutions like the Lightning Network or sidechains. These technologies aim to offload a portion of the transaction load from the main Bitcoin blockchain, improving overall throughput and efficiency.

Additionally, ongoing research and development efforts are focused on optimizing the Bitcoin protocol itself, with proposals such as Taproot and Schnorr signatures aimed at enhancing the network's scalability and privacy features.

Conclusion: Embracing the Future

Despite these challenges, the rise of Bitcoin NFTs and Ordinals represents a significant milestone in the evolution of blockchain technology and digital asset ownership. By bridging the gap between the world of non-fungible tokens and the Bitcoin network, this development has opened up a new frontier of creativity, scarcity, and value creation.

As the ecosystem continues to grow and mature, it is likely that we will witness an influx of innovative solutions and projects that leverage the unique capabilities of Bitcoin NFTs and Ordinals. From digital art galleries and collectible marketplaces to gaming platforms and beyond, the possibilities are endless.

One exciting potential application could be the creation of limited-edition digital collectibles tied to real-world events or experiences. For instance, a concert organizer could mint a series of Bitcoin NFTs representing exclusive backstage passes or memorabilia, providing fans with a unique and verifiable way to own a piece of the event.

Ultimately, the introduction of Bitcoin NFTs and Ordinals serves as a testament to the versatility and adaptability of the Bitcoin network, proving that even a decade after its inception, this groundbreaking technology continues to push the boundaries of what is possible in the realm of cryptocurrencies and digital assets.

As the world continues to embrace the principles of decentralization and digital ownership, the rise of Bitcoin NFTs and Ordinals may very well be a harbinger of a new era, where the lines between the physical and digital worlds become increasingly blurred, and the concept of value takes on a whole new meaning.

The journey towards this new frontier is just beginning, and it will be exciting to witness the innovations, disruptions, and paradigm shifts that Bitcoin NFTs and Ordinals will catalyze in the years to come. As with any groundbreaking technology, there will be challenges and obstacles to overcome, but the potential rewards are vast and far-reaching.

Whether you are an artist, collector, gamer, entrepreneur, or simply a curious observer, the rise of Bitcoin NFTs and Ordinals presents an opportunity to be part of a transformative movement that could redefine the way we interact with and perceive digital assets. Embrace this new frontier, and prepare to be part of a revolution that will shape the future of blockchain technology and digital ownership.

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.