Crypto Winter vs. Bear Market: What's the Difference?

While both crypto winters and bear markets involve declining prices and negative market sentiment, there are some key differences between the two.

The world of cryptocurrency is a rollercoaster ride, with its ups and downs leaving investors both exhilarated and perplexed. Two terms that often get thrown around in this volatile market are "crypto winter" and "bear market." While they may seem interchangeable, there are distinct differences between these two phases that every investor should understand. In this article, we'll dive deep into the nuances of crypto winter and bear markets, exploring their characteristics, causes, and potential implications for your crypto investments.

What is a Crypto Winter?

A crypto winter is a prolonged period of declining prices, diminished trading volumes, and decreased public interest in the cryptocurrency market. It's a cyclical phenomenon that follows a period of intense hype and speculation, often fueled by the launch of new projects, the emergence of disruptive technologies, or the entrance of mainstream investors.

During a crypto winter, the market sentiment turns bearish, and investors become hesitant to buy digital assets, leading to a significant drop in prices across the board. This period can last for months or even years, with prices remaining stagnant or continuing to decline gradually.

One of the most notable crypto winters occurred between January 2018 and December 2020, when the total market capitalization of cryptocurrencies plummeted from around $800 billion to below $200 billion. Bitcoin, the largest cryptocurrency by market cap, fell from its all-time high of nearly $20,000 to around $3,000 during this period.

Causes of a Crypto Winter:

- Regulatory uncertainty and crackdowns

- High-profile hacks and security breaches

- Failure of overhyped projects and ICOs

- Lack of mainstream adoption and real-world use cases

- Market cycles and investor sentiment shifts

What is a Bear Market?

A bear market, on the other hand, is a more general term used to describe a prolonged period of declining prices and negative sentiment in any financial market, including stocks, bonds, commodities, and cryptocurrencies.

In a bear market, asset prices typically experience a sustained decline of at least 20% from their recent highs. This decline is often accompanied by low trading volumes, increased investor pessimism, and a general lack of confidence in the market's future performance.

Bear markets can be triggered by various factors, such as economic downturns, geopolitical tensions, regulatory changes, or shifts in investor sentiment. They are considered a normal part of the market cycle, with periods of growth (bull markets) typically followed by periods of decline (bear markets).

Causes of a Bear Market:

- Economic recessions or slowdowns

- Geopolitical tensions and global events

- High inflation rates and rising interest rates

- Overvaluation and speculation

- Loss of investor confidence

Crypto Winter vs. Bear Market: Key Differences

While both crypto winters and bear markets involve declining prices and negative market sentiment, there are some key differences between the two:

1. Scope:

A crypto winter is specific to the cryptocurrency market, affecting digital assets like Bitcoin, Ethereum, and altcoins. A bear market, on the other hand, can impact a broader range of financial markets, including stocks, bonds, commodities, and real estate.

2. Duration:

Crypto winters tend to be more prolonged and severe than traditional bear markets. This is because the cryptocurrency market is still relatively young and highly speculative, making it more susceptible to extreme price swings and prolonged periods of low trading activity.

3. Investor Sentiment:

During a crypto winter, investor sentiment is often influenced by factors specific to the cryptocurrency ecosystem, such as regulatory uncertainty, security breaches, or the failure of high-profile projects. In a bear market, investor sentiment is typically driven by broader economic and market conditions.

4. Market Maturity:

Traditional financial markets, like stocks and bonds, are more mature and established, with a longer history and more robust regulatory frameworks. This can make them more resilient to prolonged downturns compared to the relatively nascent cryptocurrency market.

5. Adoption and Use Cases:

One of the key drivers of a crypto winter is the lack of mainstream adoption and real-world use cases for cryptocurrencies. As the market matures and more practical applications emerge, the impact of crypto winters may become less severe over time.

Navigating Crypto Winters and Bear Markets

Whether you're facing a crypto winter or a traditional bear market, there are several strategies investors can employ to navigate these challenging periods:

1. Dollar-Cost Averaging (DCA):

DCA is a investment strategy that involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help investors take advantage of lower prices during downturns and potentially build a larger position over time.

2. Diversification:

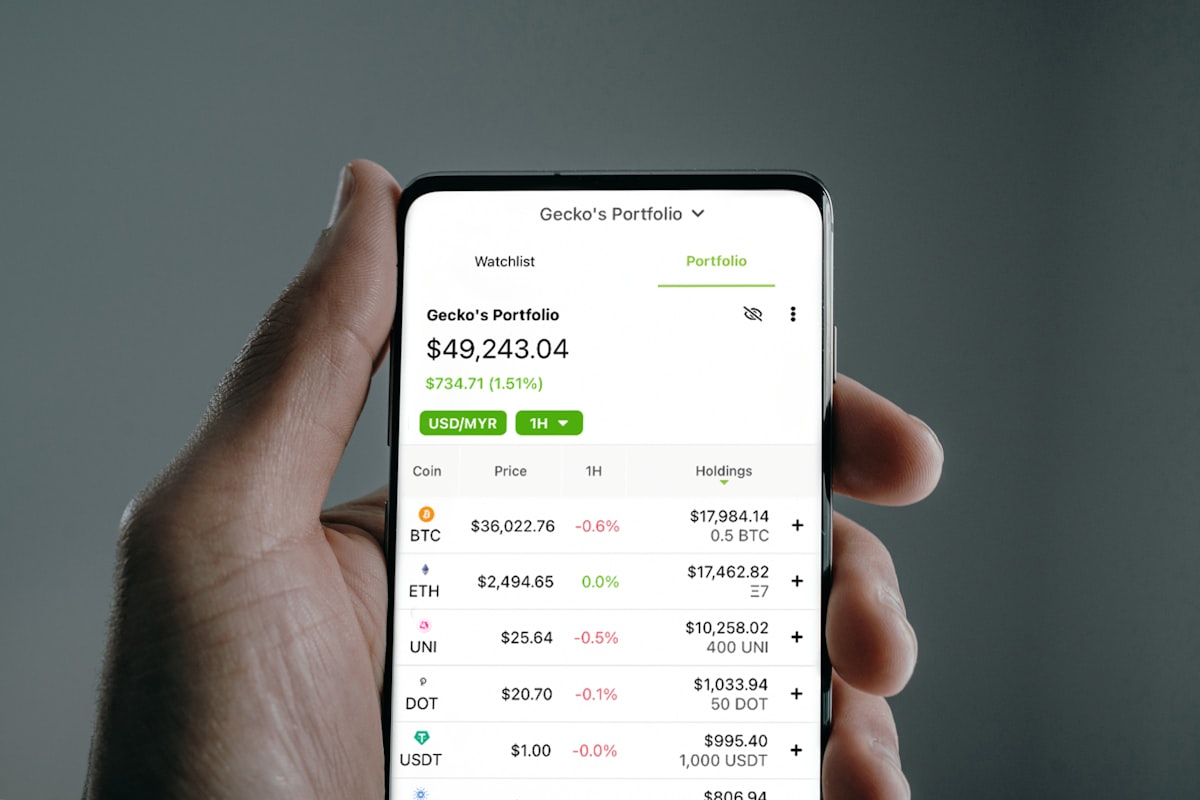

Diversifying your portfolio across different asset classes, sectors, and cryptocurrencies can help mitigate the impact of a crypto winter or bear market. By spreading your investments, you reduce the risk of being overly exposed to a single asset or market.

3. HODL (Hold On for Dear Life):

For long-term investors who believe in the underlying technology and potential of cryptocurrencies, the HODL strategy can be effective. This involves holding onto your digital assets through the market cycles, with the expectation that prices will eventually recover and appreciate over time.

4. Research and Education:

During market downturns, investors can use the opportunity to deepen their understanding of the cryptocurrency space, research new projects and technologies, and identify potential investment opportunities for when the market rebounds.

5. Risk Management:

Implementing proper risk management strategies, such as setting stop-loss orders and maintaining a well-balanced portfolio, can help protect your investments during market volatility and minimize potential losses.

Notable Examples

Throughout the history of cryptocurrencies, there have been several notable crypto winters and bear markets that have left their mark on the industry:

1. The Crypto Winter of 2018-2020:

As mentioned earlier, this prolonged crypto winter saw the total market capitalization of cryptocurrencies plummet from around $800 billion to below $200 billion. Bitcoin's price dropped from nearly $20,000 to around $3,000, and many altcoins suffered even greater losses.

2. The Bear Market of 2022:

Triggered by a combination of factors, including rising interest rates, inflation concerns, and the collapse of the Terra ecosystem, the cryptocurrency market experienced a significant downturn in 2022. Bitcoin fell below $20,000, and the total market cap dropped by over $2 trillion from its peak.

Conclusion

While crypto winters and bear markets may seem daunting, they are an inevitable part of the investment cycle. By understanding the differences between these two market phases and employing effective strategies, investors can navigate these challenging periods and potentially emerge stronger on the other side.

Crypto winters are unique to the cryptocurrency market and often stem from factors specific to the digital asset ecosystem, such as regulatory uncertainty, security breaches, and the failure of overhyped projects. Bear markets, on the other hand, are more broad-based and can impact a wider range of financial markets, driven by economic conditions, geopolitical tensions, and shifts in investor sentiment.

Ultimately, whether you're facing a crypto winter or a bear market, the key is to remain disciplined, diversified, and focused on your long-term investment goals. By doing so, you can weather the storms and position yourself for potential gains when the market eventually rebounds.

The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Readers are advised to conduct their own research and consult with a qualified financial advisor before making any investment decisions.